These are the best Sydney financial advisors and planners that we’ve found after hours of research and checking reviews, websites, and directories.

Finding a good financial adviser shouldn’t be an issue, given that the city has some of the best that Australia has to offer. But given all the great options, you could have difficulty zeroing in on the certified financial planner you want to work with long-term.

If you’re in the Sydney area and looking for independent financial planners to help you plan for your financial future, you’ll be happy to know that there are many companies and professionals to choose from. These companies and individuals are more than equipped to help you with wealth management, financial wellbeing and planning, estate planning, investing, and retirement plans preparation, among many others.

The dilemma for most people in Sydney who want to start preparing for their financial future is landing on the best financial advisor. Not to worry. We have put together a list of the ten best financial advisors in Sydney who can help you attain financial freedom.

Read on and check out what these financial advisors have to offer.

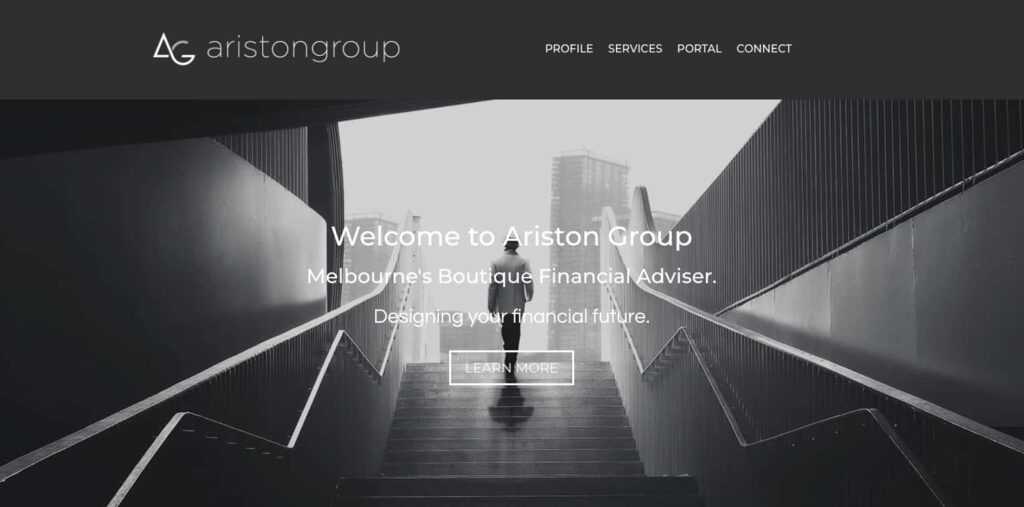

1. Ariston Group

We start off this list with Ariston Group. The financial planning firm has offices in Melbourne, Adelaide, and- yes- Sydney. The reason why we believe they deserve to be top of this list is because they mix sound knowledge of financial strategy and products, excellent client service, very transparent processes, high-quality advice, and many other strong suits.

Robert Anthony founded Ariston Group with one mission— to make boutique financial advice available to more Australians— in Sydney included. Robert has over 25 years of experience in financial services industry and has a strong passion for helping clients.

Ariston Group also provides a complimentary initial discovery consultation to anyone who would like to discuss their goals and learn more about the financial services on offer. They provide a strong financial planning strategy and excellent client services.

If you’re interested in getting a customised plan or if you need targeted solutions and advice to help you protect and grow your wealth, Artiston Capital can help you as well. Ariston Capital also adopts and integrates first-class technology platforms into its financial planning practice to streamline and secure its clients’ information and finances.

With financial planners like Ariston Group, you’ll likely get a long-term relationship — which should be the gold standard for any financial planning firm.

Ariston Group can help you with the following:

- Financial advice and planning

- Superannuation

- Investment

- Wealth Protection

- Estate Planning

- Lifestyle Planning

- And many other financial planning services

Address: Level 11, 65 York Street, Sydney NSW 2000

Website: aristongroup.com.au

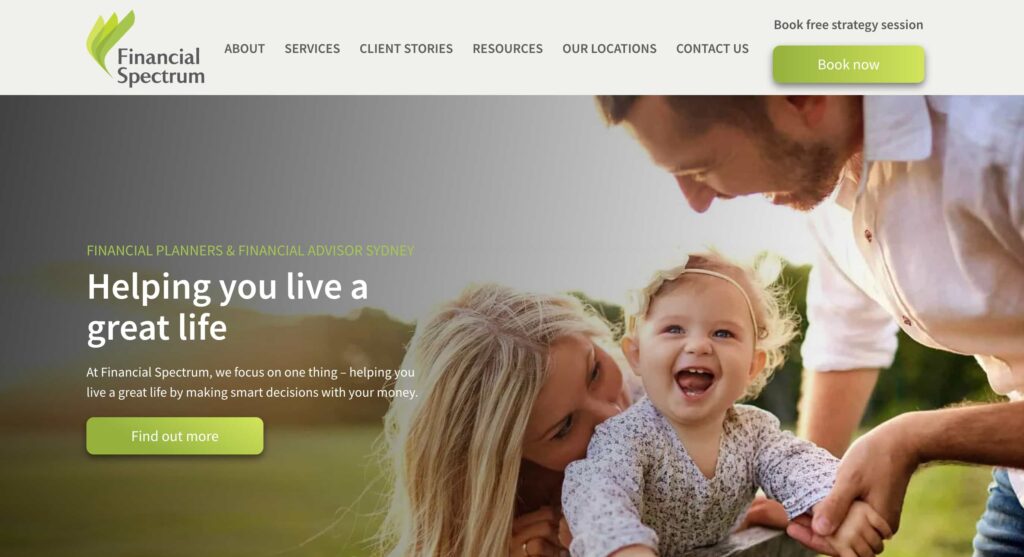

2. Financial Spectrum

Another top financial advice firm is Financial Spectrum, dedicated to helping clients live a great life by making smart decisions with their money. As a privately-owned firm, Financial Spectrum works exclusively for its clients rather than financial institutions. Their fee-only model ensures their recommendations are free from conflicts of interest, with no commissions involved.

Financial Spectrum’s approach begins with understanding each client’s vision for their life, followed by the creation of a tailored financial plan to achieve those aspirations. With extensive industry experience and a strong commitment to genuine, client-centred advice, they stand behind their service with a 100% money-back guarantee. Contact them for a complimentary strategy meeting to begin your path toward financial freedom.

Head Office Address: Level 13, 447 Kent Street, Sydney NSW 2000 (multiple locations around Sydney and Zoom consults available)

Website: financialspectrum.com.au

3. Delta Financial Group

At Delta Financial Group, the objective is simple and clear— to help their clients retire five to 15 years earlier by helping them build income through passive investments and instruments. The financial advisors at Delta provide services like retirement planning, cash flow management, tax planning, and strategic planning.

What sets Delta Financial Group apart is its commitment to providing a tailored financial strategy that a large institution can’t provide. The company creates personalised financial advice for each client. Moreover, the company takes a holistic approach to financial planning and encourages innovative thinking among their financial advisors.

Address: Level 11/22 Market St, Sydney NSW 2000

Phone: +61293274338

Website: deltafinancialgroup.com.au

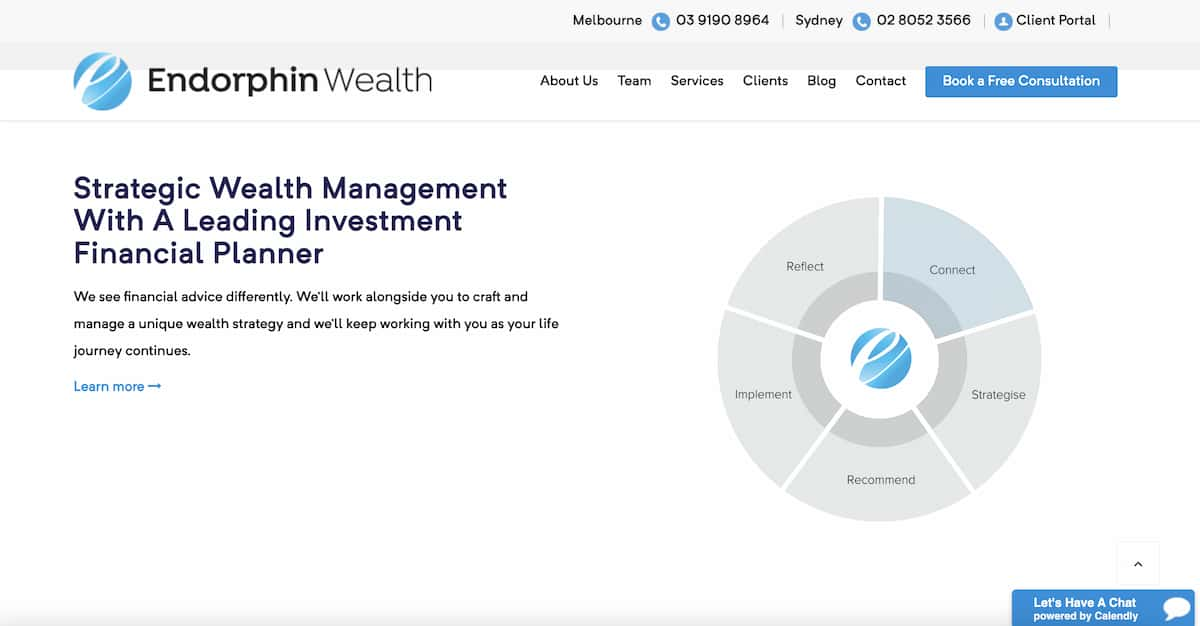

4. Endorphin Wealth Management

Endorphin Wealth Management specialises in bringing their clients strategic financial planning and wealth management services. Their financial advisors are highly experienced in personal wealth management, asset and investment management, investment advice, estate planning, and capital wealth management.

The company takes a detailed and diligent approach to wealth services, using dedicated financial planning resources and external investment research to find the best investment opportunities for their clients that optimise returns and minimise risk.

Address: Level 23/25 Bligh St, Sydney NSW 2000

Phone: +61280523566

Website: endorphinwealth.com.au

5. Montara Wealth

Montara Wealth is another leading group of financial advisors in Sydney. The firm focuses on four pillars— freedom, relationship, clarity, and convenience. The financial planning firm charges clients based on time, not the size of their investments.

Moreover, Montara Wealth promises that each client will be treated with the same level of importance and given the same service. The firm’s Director, David Hancock, has been featured in media outlets like Australian Financial Review, Daily Telegraph, Herald Sun, and news.com.au for his work in financial planning.

Address: Suite 1, Level 6/309-315 George St, Sydney NSW 2000

Phone: +61283303733

Website: montarawealth.com.au

6. Mankit Tsang of Tandem Financial

Mankit Tsang, Director and Finacial Adviser of Tandem Financial, has over fifteen years of industry experience. He has advised clients from all walks of life and with various financial goals.

Mankit is a numbers guy who has a knack for solving problems and creating clear and well-organised financial plans to help build financial security for individuals, business owners, and families. Mankit grew up in an immigrant family and worked hard to get where he is today. Today, he hopes to help other people from challenged backgrounds create more wealth for themselves.

Address: Suite 5, Level 8/99 York St, Sydney NSW 2000

Phone: +6113008982585

Website: tandemfinancial.com.au

7. Peak Wealth Management

Peak Wealth Management is a multi-award-winning financial planning firm. They have picked up awards such as the IFA excellence awards for Client Servicing Company of the Year, and Newcomer of the Year. They were also finalists for categories like Risk Adviser of the Year, Young Adviser of the Year, and more.

On top of investment planning and retirement planning advice, the company also provides excellent property advice to its clients. Peak Wealth Management has one goal— to help people live the life that they want.

Address: Level 8/99 Elizabeth St, Sydney NSW 2000

Phone: +61411472213

Website: peakwm.com.au

8. Fox & Hare Financial Advice

Fox and Hare Financial Advice is a group of excellent financial advisors who pride themselves on their warm and professional customer service. The company brings a combined fifty years of experience to the table, making them more than capable of answering all questions and giving as much guidance as possible on their client’s road to financial success.

Fox and Hare also gives coaching programs to people who want to help them set financial goals and create feasible plans to reach them in the shortest time possible.

Address: l3/223 Liverpool St, Darlinghurst NSW 2010

Phone: +61291611005

Website: foxandhare.com.au

9. Lanham Financial

Lanham is a financial planning firm that has been around since 1989 and focuses on providing a personal touch to their independent financial advice and wealth management services. It’s run by Peter Lanham, a finance expert with 30 years of experience in tax, accounting, financial advising, and corporate finance.

Lanham Financial focuses on helping their clients reach their aspirations in life through proper financial planning, advice, and practical roll-out strategies.

Address: Suite 8, 1st Floor 38-40 Urunga Parade, Miranda, NSW 2228 and Ground Floor, 312 New South Head Road, Double Bay, NSW, 2028

Phone: (02) 9160 0288

Website: lanham.com.au

10. James Gerrard of FinancialAdvisor.Com.Au

Last but not least on this list is James Gerrard, a finance professional named one of Australia’s top 50 financial advisers by Wealth Professional. He runs FinancialAdvisor.Com.Au, a professional financial advice company that serves individuals, couples, and families.

James’ core values are clarity, empathy, and value. He believes in providing the proper structure and advice to help people become more deliberate and wise in their financial decisions. His clients have worked with him because of his proactivity and ability to plan for the long-term.

Address: Level 11, 99 York Street, Sydney NSW 2000

Phone: +611300881818

Website: financialadvisor.com.au

Frequently Asked Questions (FAQs)

How much does a financial advisor cost in Sydney?

Financial advisors in Sydney typically charge to set up a financial plan, which will start at around $3,300. Then you’ll also pay them an annual fee, with averages starting at $4,000 and up depending on the firm.

Other advisors might charge a percentage of the assets they manage on your behalf, usually around 1% to 2% per year. We don’t recommend taking this route, though, especially if you have a large amount of wealth for someone to manage.

You should clarify the fee structure before engaging an advisor. Costs can vary significantly based on the advisor’s qualifications, the scope of services, and whether they provide ongoing support or a one-time consultation.

Is it worth paying for a financial advisor in Australia?

Yes, paying for a financial advisor in Australia can be worth it. If you need help managing complex financial situations or planning for long-term goals, you’ll likely need the help of a financial planner.

A good financial advisor can provide tailored advice to help you achieve financial stability, grow your investments, and plan for retirement. They can also assist with tax strategies, self-managed super funds, estate planning, and risk management, potentially saving you money and maximising your wealth over time.

Additionally, advisors can help you stay disciplined with your financial plan and make informed decisions, which can be invaluable in navigating market fluctuations and life changes.

The key is to ensure that the advisor’s fees are justifiable and the services they provide and guidance they give are effective. At the end of the day, you should also look at the improvements they help you achieve in your financial situation.

What to avoid in a financial advisor?

When selecting a financial advisor, there are several red flags to watch out for:

- Lack of Transparency. Avoid advisors who are not upfront about their fees, commissions, or any potential conflicts of interest.

- Poor Communication. Steer clear of advisors who are unresponsive or fail to explain financial concepts in a way you can understand.

- High-Pressure Sales Tactics. Be wary of advisors who pressure you into making quick decisions or purchasing specific financial products.

- Lack of Credentials. Check that your advisor has appropriate qualifications and is registered with a recognised professional body, such as the Financial Planning Association of Australia (FPA).

- Negative Reviews. Check for negative reviews or complaints from previous clients, which can indicate a pattern of poor service or unethical behavior.

- Overpromising Returns. Be cautious of advisors who guarantee high returns or promise outcomes that seem too good to be true, as no investment is without risk.

Final Words

Choosing the right financial advisor in Sydney starts with understanding what they do, evaluating the potential value they bring, and knowing who to work with.

When you’re looking for an advisor, transparency, communication, credentials, and a solid reputation are key factors to consider. Find the right advisor that fits your best interests, and you will confidently navigate your financial journey and achieve your long-term financial goals.

You would do well to start with the list of recommendations we provided above. All the best!